CMCT Projection of Income 2019-2025 free printable template

Show details

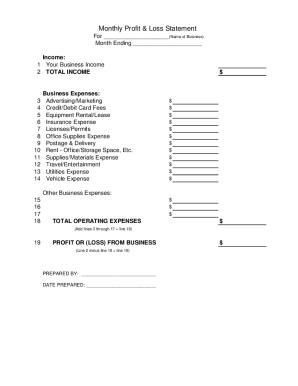

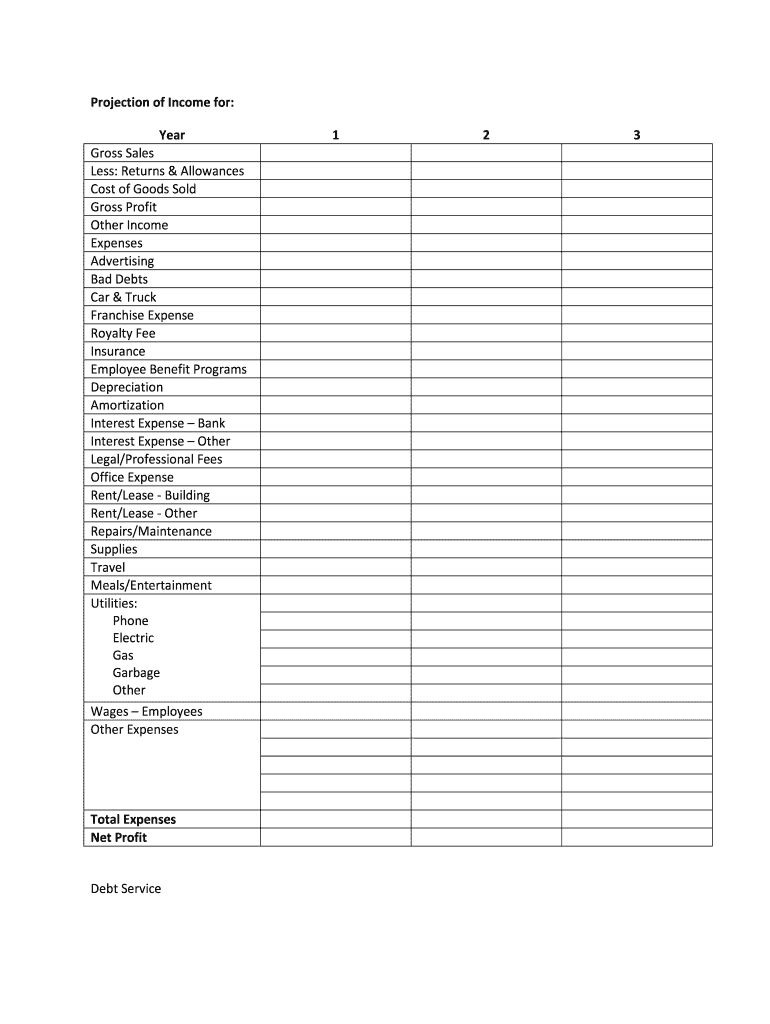

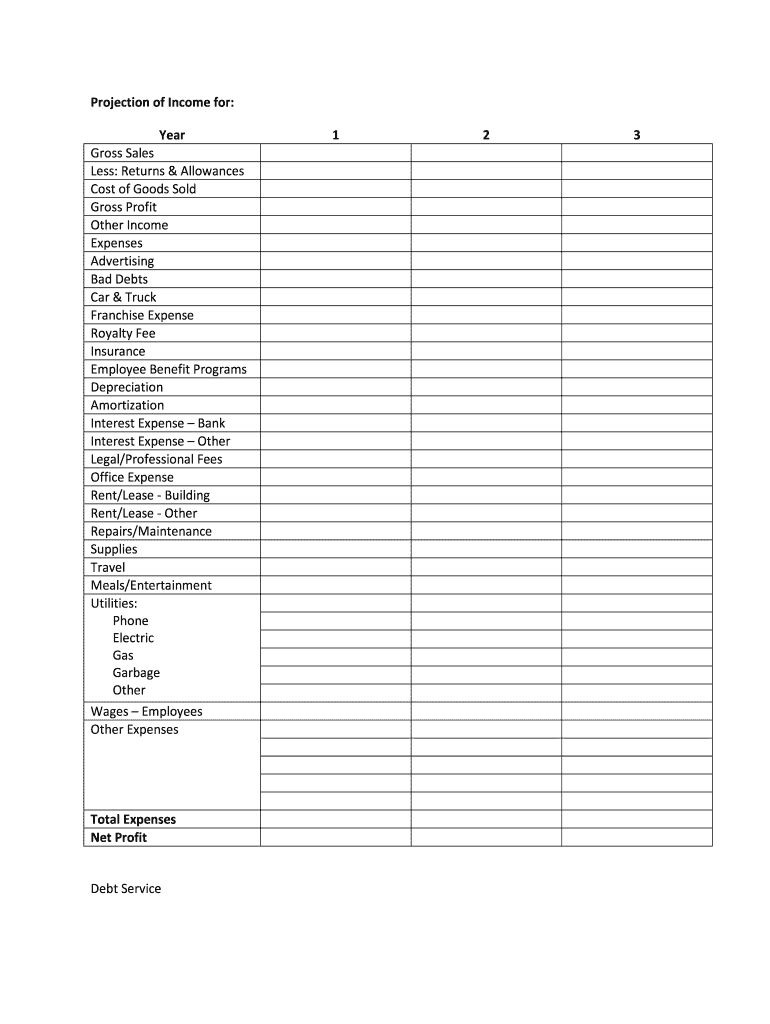

Projection of Income for: Year Gross Sales Less: Returns & Allowances Cost of Goods Sold Gross Profit Other Income Expenses Advertising Bad Debts Car & Truck Franchise Expense Royalty Fee Insurance

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign year to date profit and loss statement template form

Edit your ytd profit and loss statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your year to date profit and loss template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ytd p l template online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ytd profit and loss statement template form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ytd p l form

How to fill out CMCT Projection of Income

01

Gather financial data, including revenue and expense estimates.

02

Open the CMCT Projection of Income template.

03

Input your projected sales or service revenue in the designated section.

04

List all expected expenses, including fixed and variable costs.

05

Include any anticipated taxes or deductions.

06

Calculate the total income by subtracting total expenses from total revenue.

07

Review all entries for accuracy and completeness.

08

Save and document the projection for future reference.

Who needs CMCT Projection of Income?

01

Small business owners seeking to forecast profits.

02

Startups planning for financing or investments.

03

Financial analysts preparing reports.

04

Accountants assisting clients with financial planning.

05

Investors evaluating potential business opportunities.

Fill

interim ytd profit loss

: Try Risk Free

People Also Ask about ytd p l and balance sheet

How do I create my own P&L?

To create your P&L manually, you need to gather all relevant information. This includes items of income and expenses. This information can be derived from invoices, receipts, credit card statements, and bank account transactions.

What is a year end profit and loss statement?

Profit and Loss (P&L) Statement A P&L statement, often referred to as the income statement, is a financial statement that summarizes the revenues, costs, and expenses incurred during a specific period of time, usually a fiscal year or quarter.

What is the year-to-date profit?

YTD return refers to the amount of profit made by an investment since the first day of the current year. Investors and analysts use YTD return information to assess the performance of investments and portfolios.

Who can complete a profit and loss statement?

You can ask your accountant to prepare a profit and loss statement for your company or you can build one yourself using the steps below.

Can I do my own profit and loss statement?

To create your P&L manually, you need to gather all relevant information. This includes items of income and expenses. This information can be derived from invoices, receipts, credit card statements, and bank account transactions.

How do I create a year-to-date profit and loss statement?

How to Write a Profit and Loss Statement Step 1 – Track Your Revenue. Step 2 – Determine the Cost of Sales. Step 3 – Figure Out Your Gross Profit. Step 4 – Add Up Your Overhead. Step 5 – Calculate Your Operating Income. Step 6 – Adjust for Other Income and/or Expenses. Step 7 – Net Profit: The Bottom Line.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send profit and loss statement template for eSignature?

ytd income statement is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an eSignature for the year to date profit and loss statement and balance sheet in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your year to date profit and loss and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I edit interim profit and loss statement on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit profit and loss statement pdf download.

What is CMCT Projection of Income?

CMCT Projection of Income is a financial document that estimates the expected income for a specified period, primarily used for planning and budgeting purposes.

Who is required to file CMCT Projection of Income?

Businesses and individuals who are involved in commercial activities and are subject to income reporting requirements are typically required to file the CMCT Projection of Income.

How to fill out CMCT Projection of Income?

To fill out the CMCT Projection of Income, one must gather financial data, estimate future income based on past performance and current market conditions, and accurately input this information into the prescribed format.

What is the purpose of CMCT Projection of Income?

The purpose of the CMCT Projection of Income is to provide a forecast of potential earnings, which assists in financial planning, resource allocation, and measuring financial performance.

What information must be reported on CMCT Projection of Income?

Information that must be reported includes projected revenues, anticipated expenses, gross profit, net income, and assumptions made for the projections.

Fill out your CMCT Projection of Income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Year To Date Profit And Loss Statement Example is not the form you're looking for?Search for another form here.

Keywords relevant to year to date income statement template

Related to year to date p l statement

If you believe that this page should be taken down, please follow our DMCA take down process

here

.